Installment Plans Vs. Loans: Which Is More Profitable When Purchasing Jewellery Collections

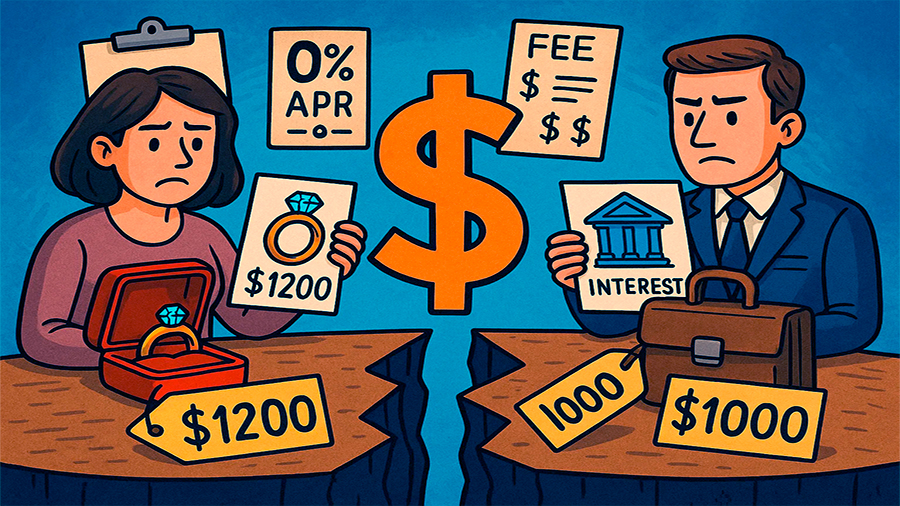

Buying jewellery collections, whether for personal passion or investment, is rarely a small expense. Diamonds, sapphires, or gold sets often require a significant outlay, and most buyers turn to financing options. Two common choices dominate the landscape: installment plans offered by sellers and traditional bank loans. At first glance, they might appear similar—both let you spread payments over time rather than paying everything upfront. But the terms, hidden costs, and long-term financial impacts differ in subtle ways. For collectors and investors, understanding these differences can determine whether the purchase becomes a profitable decision or an expensive misstep.

How Installment Plans Work In The Jewellery Market

Installment plans are usually arranged directly through jewellers or retailers. Instead of paying the full amount upfront, you commit to monthly payments over a fixed period. In many cases, retailers promote “interest-free” plans, where the price is divided into equal installments. The appeal is obvious: no third party, no lengthy bank application, and quick approval at the point of sale. However, installment agreements often come with conditions—missed payments may trigger penalties, and “interest-free” offers sometimes mask hidden administrative fees. For buyers drawn to convenience, installment plans can feel like the easiest route. Yet their simplicity can also disguise the true cost when compared to bank lending.

The Role Of Retailers In Financing

Jewellers use installment offers to boost sales. By lowering the upfront cost barrier, they expand their customer base and move inventory faster. For buyers, the direct relationship with the seller creates speed, but it also means fewer protections if disputes arise. Unlike banks, retailers are not regulated lenders, which shifts risk onto the consumer.

Traditional Loans For Jewellery Purchases

Banks and credit institutions approach jewellery financing differently. A loan involves a formal application, credit checks, and fixed interest charges over a defined term. Approval takes longer, but the structure is usually clearer. The borrower knows exactly how much interest will accrue, how long repayment will last, and what monthly obligations will be. Unlike installment plans, loans can be flexible in size and length, depending on negotiation. For large jewellery collections, loans may be the only realistic option, since retailers rarely extend installment financing beyond certain limits. The predictability of loan terms is a key advantage, even if the process feels more formal and slower.

The Discipline Factor

Loans often create more discipline. Borrowers must commit to structured repayment with less room for missed payments or casual extensions. This framework can be beneficial for investors who value clarity and consistency in financial planning.

Comparing Costs: Where Differences Appear

On paper, an interest-free installment plan looks cheaper than a bank loan with even modest interest. But reality is more complex. Retailers may inflate the price of jewellery sold on installment, offsetting the “interest-free” claim. Administrative or insurance fees sometimes accompany these deals, raising effective costs. Meanwhile, loans present interest openly but may allow negotiation, especially for high-value purchases. The real comparison lies in total cost, not advertised conditions. Buyers focused only on short-term monthly amounts risk ignoring how much more they pay in the long run. Both systems, if misunderstood, can erode profitability.

The Danger Of Overconfidence

Installment marketing often encourages buyers to stretch budgets. When the monthly cost looks small, people commit to bigger collections than they can afford. Loans, though stricter, make the financial burden more visible. In this sense, loans may prevent overextension, while installment plans sometimes promote it.

Flexibility And Control

Another factor to weigh is flexibility. Installment plans rarely allow early repayment without penalties. Buyers who want to clear the debt faster may find themselves locked into rigid agreements. Loans, by contrast, often allow prepayment with reduced interest costs, especially if negotiated upfront. For investors who expect fluctuating liquidity—perhaps from selling pieces in a collection—loan flexibility can be more profitable. Control also extends to collateral. While some loans require collateral, others are unsecured. Installment plans are tied directly to the jewellery purchase, meaning the item itself may not be transferable until payments are complete.

Liquidity Considerations

Collectors buying with investment intent should think about liquidity. Jewellery purchased under installment plans may not be easy to resell while payments remain outstanding. Loans generally provide clearer ownership rights, giving buyers more freedom to use or resell their assets if necessary.

Risk Management In Financing Jewellery

Both methods carry risks. With installment plans, defaulting on payments may lead to repossession of the jewellery and forfeiture of prior payments. Retailers tend to enforce strict penalties because their margins depend on compliance. With loans, the risk is broader—default damages credit history, potentially affecting future borrowing. For some borrowers, the reputational and long-term cost of loan default is more severe than losing an individual item under installment. Balancing these risks requires self-awareness: are you more comfortable with a direct retail agreement or a bank-managed repayment structure? Each carries different consequences.

Transparency Issues

Retail installment contracts are often less transparent than bank loans. Many consumers enter them without reading fine print, only to discover charges later. Banks, while bureaucratic, tend to be more transparent due to regulatory oversight. That transparency can make loans more predictable despite their apparent cost.

Investment Value And Profitability

When jewellery is purchased as an investment, financing choices directly impact profitability. If the financing structure inflates costs significantly, future resale margins shrink. For collectors expecting appreciation in gemstones or precious metals, minimizing financing expenses is critical. In this sense, bank loans with clear interest rates may offer better predictability, while installment plans may introduce hidden variables that reduce profits. Serious investors often prefer loans, even with interest, because they allow accurate forecasting. Casual buyers, focused more on ownership than resale, may accept installment costs as the price of convenience.

The Long-Term Investor’s View

Long-term investors weigh total acquisition cost against expected appreciation. If a rare diamond is likely to rise in value, taking a bank loan with predictable interest may ensure profitability upon resale. Installment plans, though convenient, risk reducing future margins if hidden costs accumulate.

Suitability For Different Buyers

There is no single best option; profitability depends on buyer type. Installment plans suit buyers seeking convenience, smaller purchases, or those less focused on resale value. Loans fit larger acquisitions, serious collectors, or investors treating jewellery as part of diversified portfolios. Matching financing to purpose is the real determinant of profitability. Without that alignment, even the best financial product can become a liability.

Small Buyers Versus Large Collectors

Someone purchasing a modest jewellery set may find installment plans sufficient. But a dealer acquiring entire gemstone collections for resale will likely benefit from bank financing. Scale matters when choosing the right financing path.

The Cultural Dimension

In many markets, installment plans carry cultural weight. Retailers promote them heavily to middle-class consumers, normalizing debt for luxury items. Loans, meanwhile, are viewed as more serious commitments. These cultural perceptions influence buyer behavior. In societies where installment plans are popular, consumers often overlook their real costs. In contrast, where loans dominate, buyers may act more cautiously. Cultural attitudes toward debt shape which financing method appears more profitable, even if the numbers suggest otherwise.

Marketing Influence

Retail advertising glamorizes installment plans as accessible luxuries, while banks present loans as serious financial tools. This difference in marketing tone influences perception as much as actual cost structures.

The Conclusion

Choosing between installment plans and loans when purchasing jewellery collections is not simply a financial calculation. It is about convenience, transparency, flexibility, and long-term profitability. Installment plans offer speed and simplicity but may carry hidden costs and rigid terms. Loans require more effort upfront but often provide greater clarity and flexibility, especially for investors seeking predictable margins. For buyers motivated by convenience, installment plans may work. For those focused on profitability, especially in investment-grade jewellery, loans tend to be the safer bet. In the end, the choice reflects not only financial realities but also personal priorities—whether you value instant access or long-term control.