The Paradox Of Choice: When Too Many Loans Are A Bad Thing

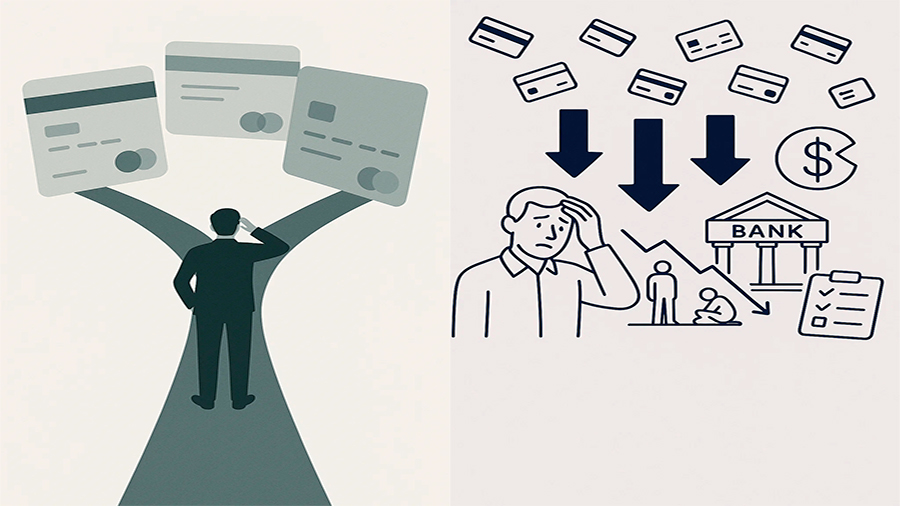

In theory, more choice should make life easier. If customers can pick from dozens of loan products, they should be able to find one that fits perfectly. Yet, in reality, an abundance of credit options often creates the opposite effect. Too many loan types, variable rates, promotional offers, and repayment structures leave people confused. Instead of empowering borrowers, excess choice can lead to rushed decisions, hidden costs, and long-term mistakes. This is the paradox of choice in lending: more options do not always mean better outcomes. Understanding why this happens and how to navigate it is essential for anyone borrowing money in today’s crowded credit market.

Why Too Many Choices Create Confusion

When lenders compete aggressively, they flood the market with new products. Personal loans, payday loans, credit cards, installment plans, mortgages, and fintech-based microloans all compete for attention. Each comes with different terms, interest rates, and eligibility requirements. The sheer variety overwhelms borrowers who lack financial expertise. Instead of carefully comparing offers, many people rely on surface impressions or marketing claims. This confusion often leads to poor matches between borrower needs and loan structures. For businesses, the same problem arises when multiple lines of credit, leasing options, or trade finance products overlap. Excess variety increases cognitive load, making it harder to identify the best deal.

The Psychology Of Overchoice

Behavioral research shows that too many options can paralyze decision-making. Borrowers confronted with twenty loan offers may either delay their decision or pick impulsively without thorough analysis. Both outcomes increase risk.

| Number Of Options | Customer Response | Risk Of Mistakes |

|---|---|---|

| Few Options (3–5) | More deliberate comparison | Lower |

| Moderate Options (6–10) | Healthy competition, some confusion | Medium |

| Too Many Options (10+) | Overwhelm, rushed decisions | High |

Marketing And The Illusion Of Benefits

Lenders use promotions to stand out in saturated markets. “Zero interest for six months,” “instant approval,” or “cashback rewards” are common hooks. While these features sound appealing, they often hide long-term costs such as higher ongoing rates or fees. When borrowers face dozens of such offers, the marketing noise makes it even harder to evaluate the real cost of borrowing. Instead of focusing on the effective annual rate or repayment terms, borrowers may chase perks. This creates situations where the abundance of choice distracts from the fundamentals, leading to expensive mistakes down the road.

Comparing Surface Versus Core Features

The core of any loan is simple: how much you borrow, how much you repay, and under what conditions. Yet promotional language shifts attention away from these essentials. Borrowers overwhelmed by choice often overlook the basics.

| Loan Feature | Promotional Hook | Underlying Reality |

|---|---|---|

| Credit Card | “Points on every purchase” | High interest if balance not cleared |

| Personal Loan | “Fast approval within 24 hours” | Hidden origination fees |

| Payday Loan | “Quick cash, no credit check” | Very high effective interest |

| Mortgage | “Low initial rate” | Rates may adjust upward later |

How Loan Abundance Leads To Mistakes

The more crowded the credit market becomes, the more room for error. Borrowers commonly take on loans without reading fine print or understanding repayment schedules. Others underestimate their ability to juggle multiple products at once, creating overlapping debts. Some are misled by teaser rates that rise sharply after a few months. In extreme cases, borrowers combine products—credit cards, payday loans, personal loans—into cycles of refinancing that create long-term instability. Too many choices increase the chance of mismatch: using short-term loans for long-term needs, or choosing high-interest credit when lower-cost options were available.

Debt Stacking As A Symptom

One clear sign of confusion is debt stacking—using new loans to repay older ones. While this can provide temporary relief, it usually worsens financial positions over time. The abundance of available loans makes it easier to fall into this cycle.

Impact On Businesses

Companies face similar challenges when financing operations. Small and medium enterprises often receive overlapping offers: trade credit from suppliers, leasing for equipment, bank loans for expansion, and fintech credit lines for working capital. While choice is good, too many products with similar structures blur distinctions. Business owners under pressure may choose financing without fully calculating long-term costs. Mistakes at this level can undermine growth strategies, force restructuring, or even push firms into insolvency. Just as with individuals, too many choices can paralyze or mislead businesses, eroding their financial resilience.

Operational Overload

Managing multiple credit agreements requires administrative capacity. Smaller businesses often lack this, making mistakes more likely. Abundance doesn’t always equal strength—it can create hidden fragility.

| Business Loan Option | Perceived Benefit | Hidden Risk |

|---|---|---|

| Supplier Credit | Flexible repayment | Can lock firm into dependency |

| Equipment Leasing | Preserves cash flow | Higher long-term cost than purchase |

| Bank Term Loan | Stable financing | Rigid repayment obligations |

| Fintech Credit Line | Instant liquidity | High fees, fluctuating terms |

Strategies To Navigate Excess Choice

If abundance creates confusion, the solution lies in simplifying decision-making. Borrowers can use comparison tools, financial advisors, or simple rules of thumb to cut through noise. The focus should always be on total cost, repayment flexibility, and alignment with actual needs. For businesses, adopting structured financial planning helps prioritize loans that serve growth rather than short-term survival. The key is shifting perspective: instead of asking “Which loan looks most attractive?” borrowers should ask “Which loan actually matches my needs without hidden costs?” This reframing reduces the risk of costly mistakes in saturated credit markets.

Filtering Out Distractions

Borrowers should avoid being swayed by flashy promotions. Checking the effective annual percentage rate, comparing repayment terms, and calculating total repayment amounts are more reliable ways to evaluate loans. Stripping choices down to core essentials helps clarity return.

The Social Cost Of Too Many Credit Options

At a broader level, an overabundance of loan products creates systemic risks. When consumers or businesses take on unsuitable debt, default rates rise. This undermines trust in financial systems and strains banks and lenders. Societies with excessive loan options may see widening inequality, as financially literate borrowers benefit while others fall into traps. Regulatory bodies face challenges too, since monitoring hundreds of product variations is difficult. In this sense, the paradox of choice is not just personal—it reshapes economies.

The Role Of Regulation

Governments can help by simplifying disclosure requirements and ensuring that loan terms are presented in clear, comparable formats. Some countries already mandate “key facts” statements to reduce confusion, but more could be done to protect borrowers in saturated credit markets.

The Conclusion

Choice is often celebrated as freedom, but in lending, too much choice can backfire. An abundance of credit products overwhelms consumers and businesses, leading to mistakes, mismatches, and long-term financial stress. The paradox of choice means that sometimes fewer, simpler options would better serve borrowers. Navigating this environment requires stripping away marketing noise, focusing on fundamentals, and aligning credit decisions with real needs. Until then, more choice will remain a double-edged sword—promising empowerment but often delivering confusion.